| No | App | Price | Link |

|---|---|---|---|

| 1 |

|

Try for free | |

| 2 |

|

Try for free | |

| 3 |

|

Try for free | |

| 4 |

|

Try for free | |

| 5 |

|

Try for free | |

| 6 |

|

Try for free | |

| 7 |

|

Try for free | |

| 8 |

|

Try for free | |

| 9 |

|

Try for free | |

| 10 |

|

Try for free | |

| 11 |

|

Try for free | |

| 12 |

|

Try for free | |

| 13 |

|

Try for free | |

| 14 |

|

Try for free | |

| 15 |

|

Try for free | |

| 16 |

|

Try for free | |

| 17 |

|

Try for free | |

| 18 |

|

Try for free | |

| 19 |

|

Try for free | |

| 20 |

|

Try for free |

Downpay: Deposits made simple offers flexibility in payment options, perfect for high-value, made-to-order products. By allowing partial payments or deposits on preorder items, it not only enhances customer loyalty but also optimizes sales. The app supports Shopify features and ensures a seamless buyer journey.

The app's reviews highlight its efficacy and user-friendly nature. Customers appreciate the ability to handle deposits on future inventories, thus mitigating inventory risks and increasing purchase orders. The intuitive interface allows for easy management of subsequent payments. Users commend the responsive and helpful support team, ensuring reliability in money and order transactions.

Deposit & Split Payment Depo is a comprehensive app designed for managing partial or split payments, pre-orders, subscriptions, and deposits within your store. It allows you to efficiently handle deposits, manage draft order deposits, and automate payments to boost your average order value (AOV) and increase sales.

Customers highly rate Deposit & Split Payment Depo for its flexibility and security in handling deposit and partial payment options. The app makes larger purchases and bookings easier to commit to without financial strain, providing both parties with ease and clarity in payment management. - Rating: 5/5

KlinKode PayRules is a versatile app designed to streamline the checkout process by allowing merchants to hide specific payment methods like Cash on Delivery under various conditions. This helps to reduce unwanted financial risks such as chargebacks and account freezes while enhancing customer satisfaction and increasing conversion rates by offering a more customized checkout experience.

The app's outstanding advantages include its ability to offer selective payment terms to approved customers, ensuring only those with pre-approved credit can select specific payment methods, thereby reducing administrative hassles. Users have praised its ease of use and excellent customer support, highlighting its efficiency in customizing payment options according to business needs.

Split Payment & Deposit SpurIT is a versatile 4-in-1 app designed to enhance your retail sales by providing various payment options. It allows customers to make deposits, use multiple payment methods in a single transaction, share payments, and pay in installments.

The app has received outstanding reviews for its ease of use, seamless integration with Shopify themes, and excellent customer support. It is particularly beneficial for handling high-value items, offering effective installment payment solutions without any associated sales fees. Users commend the swift and efficient customer service, highlighting specific team members for their assistance.

Komfortkasse Offline Payments automates the assignment of transactions in the background, ensuring a fault-tolerant process even when order details don't match perfectly. It also facilitates automatic payment reminders and direct refunds without requiring a user bank account, using its integrated European bank accounts.

Reviews highlight the app's seamless automation, excellent support, and reliability in processing prepayment orders. Users appreciate its ease of setup and how it instills trust with integrated European bank accounts, recommending it highly for its robust performance.

TryOnify empowers merchants by enabling a truly risk-free shopping experience. It allows customers to try products before they buy, encouraging them to take the first step towards a purchase. Merchants can configure trial length, product eligibility, and deposit amounts to suit their needs.

The reviews highlight TryOnify's outstanding advantages, emphasizing its simplicity, effectiveness in boosting sales, and seamless payment processes. Users appreciate the customizable trial settings and the app’s contribution to increased customer satisfaction and loyalty.

The Bread Pay Messaging app enables customers to apply and pre-qualify for financing early in their shopping journey, offering transparent financing options to enhance purchasing power and drive sales. The entire prequalification and checkout process is completed in under 60 seconds, ensuring seamless information transfer to the retailer’s server once an order is placed.

Users of the Bread Pay Messaging app praise its speed and transparency in the financing process, highlighting how it seamlessly integrates into the shopping experience and effectively increases purchasing power. The app's ease of use and its capability to provide immediate and clear terms stand out as key advantages in customer feedback.

The SpurIT Installment Invoices app allows customers to make purchases over time with installment recurring invoices, enabling them to buy more expensive items and ultimately increasing your average order value (AOV). It offers flexible payment plans and customization options to suit your business needs.

The app receives high praise for its customizable payment options and user-friendly interface. Users appreciate the flexibility to set payment terms that suit their business model, as well as the ability to modify the initial payment percentage. The recurring invoice feature is highlighted as a major convenience, ensuring customers receive reminders without any additional effort from the seller, streamlining the process and enhancing customer satisfaction.

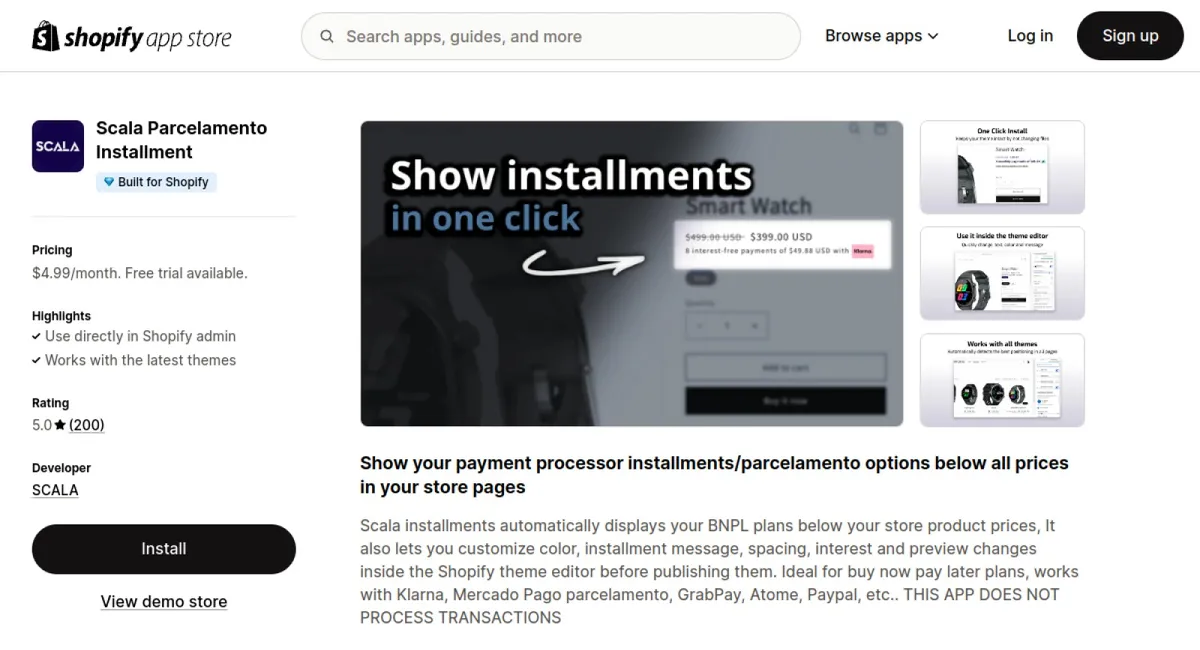

Scala Parcelamento Installment displays BNPL plans beneath store product prices and allows customization of various elements through the Shopify theme editor, providing an ideal solution for buy now, pay later options with compatibility for multiple payment platforms.

The app is praised for its excellent performance, especially for international theme users, offering immediate support and outstanding customer service with a rating of 5/5.

Super Payments Marketing app is designed to enhance your customers' shopping experience by promoting the availability of Super Payments as a payment option. It allows you to customise your messaging on various shopping touchpoints, such as site banners, product pages, and shopping carts, encouraging customers to utilize Super Payments and gain cash rewards.

According to reviews, Super Payments Marketing stands out for its user-friendly interface that allows easy customization of messages and themes. Users appreciate the noticeable increase in customer engagement and sales due to the effective highlighting of payment benefits. Additionally, the app's seamless integration and support significantly enhance the overall shopping experience.

Cashfree BNPL Plus is a seamless, no-code solution designed to enhance your Shopify store by offering flexible payment options like EMIs and Pay Later directly on product pages, reducing customer drop-offs and increasing average order value.

Customers appreciate the app for its ease of use and the positive impact on sales, with reviews highlighting the smooth integration process and significant improvements in purchase completion rates. Users have noted the intuitive interface and effectiveness of payment options in reducing cart abandonment, contributing to higher customer satisfaction and increased revenue.

The WeGetFinancing Messaging app offers a Purchase Power Estimator that brings financing options directly to customers. By allowing them to choose their credit range on the product page, it provides detailed monthly payment information. This feature enhances customers' understanding of payment ability, boosts click-thru rates, ticket sizes, and conversion rates.

The app is praised for its user-friendly interface and effective communication of financing options that make it easier for customers to understand and utilize financing. Many reviews highlight its positive impact on boosting sales metrics such as click-thru rates and conversion rates, while providing a tailored approach to financing that caters to various credit scores.

Koin - Cashback & Store Credit is designed to enhance customer retention, encourage repeat purchases, and foster loyalty by offering cashback and store credit rewards. The app provides flexible customization, real-time balance tracking, and effortless reward management. Seamlessly integrated with Shopify's store credit system, it ensures a smooth checkout process using Shopify's payment features, all through an intuitive interface that benefits both merchants and customers.

The app receives high praise for its outstanding advantages, including its user-friendly interface, seamless integration with Shopify, and effective enhancement of customer retention and loyalty. Users appreciate the customization options and hassle-free setup process, which enables them to quickly implement a robust rewards system and improve customer satisfaction.

The seQura On-Site Messaging App is a tool that allows users to easily customize, preview, and publish on-site messages using a visual editor, without the need for any coding knowledge. It's designed to effectively promote seQura payment solutions during the customer's purchasing journey, ultimately boosting conversion rates and encouraging repeated use through flexible payment options.

Users appreciate the app for significantly increasing their conversion rates by simplifying the messaging process with its intuitive visual editor. The integration of seQura's flexible payment solutions at key stages of the purchase journey has been highlighted as a major advantage, contributing to an overall smooth customer experience.