Managing taxes is one of the most complex aspects of running an online store, especially when selling to customers across different states, countries, and tax jurisdictions. For Shopify store owners, staying compliant while ensuring accurate tax calculations can quickly become overwhelming without the right tools in place.

That’s where dedicated tax apps come in. These apps help automatically calculate the correct taxes at checkout, generate compliant tax reports, and even assist with tax filing. Whether you’re handling sales tax, VAT, or GST, having an app that simplifies this process saves time and reduces costly errors.

To help you choose the best solution, we’ve compiled a list of the top 11 taxes apps in 2025 for Shopify. These apps are designed to keep your store tax-compliant while making the process easy to manage.

Best Tax Apps for Accurate Calculations and Hassle-Free Reporting

Sufio: Professional Invoices is an app designed to automatically create and send professional invoices, credit notes, and other documents, tailored to suit your business needs. It ensures compliance with global regulations for B2C and B2B sales, helps build your brand with customizable templates, and offers stellar support for configuring invoices and taxes.

- Automatic Document Creation: Instantly generate invoices, credit notes, receipts, and reminders to streamline your billing processes.

- International Compliance: Produce legislation-compliant documents translated into all major languages, meeting worldwide regulations.

- Brand Customization: Customize your invoices with your logo, brand colors, and premium fonts to create professional and unique designs.

- Efficient Batch Processing: Print or download thousands of PDFs at once, allowing for easy distribution and record-keeping.

- B2B Sales Support: Validate EU VAT numbers and mark customers as tax-exempt to facilitate seamless B2B transactions.

Sufio: Professional Invoices receives outstanding reviews for its user-friendly interface, efficient automation of invoices, and excellent customer support. Users appreciate its seamless integration with Shopify, ability to handle VAT, and the personalized assistance, enabling smooth operation for both B2B and B2C transactions. Rated highly for automated and manual invoice generation tailored to specific needs, Sufio stands out as a top invoicing solution with prompt and effective support.

WebPlanex: GST Invoice India is an efficient tool that automates the creation of GST-compliant invoices from your order data, eliminating the need for third-party software. It features automated customer emails, location-based GST calculations, and branded invoice generation, making it invaluable for multi-location fulfillment.

- Automated GST Invoices: Automatically fetches order data to generate GST-compliant invoices, streamlining the invoicing process.

- Location-Based GST Calculation: Allows calculation of GST based on the inventory fulfillment location, suitable for businesses with multiple locations.

- Branded Invoice Generation: Provides customizable branded invoices with store logos and other essential business details.

- Sales Reports: Offers detailed sales reports with data necessary for GSTR-3B and GSTR-1 returns.

- Customizable Templates: Features four different invoice templates that users can customize to suit their specific needs.

Based on user reviews, WebPlanex: GST Invoice India is highly rated for its user-friendly interface, seamless GST invoicing, and customization options. Customers commend the exceptional customer support, especially highlighting personalized assistance and swift problem resolution. It is praised as a game-changer for simplifying GST processes, making it highly recommended for businesses in India seeking effective invoicing solutions.

This Shopify invoice generator assists B2B and wholesale merchants in achieving tax compliance across various regions, such as the EU, Canada, and India. Users can customize professional PDF invoice templates to reflect their brand identity, batch print, and download orders, and set up automated multilingual and currency-specific invoices without the need for coding. The app offers 24/7 live chat support.

- Customizable Invoice Templates: Create on-brand professional invoices by selecting from pre-designed templates or customizing them to fit your brand style.

- Tax Compliance Support: Ensures tax compliance for B2B and wholesale operations in key global markets, including the EU, Canada, and India.

- Batch Printing and Downloading: Streamline operations by batch printing and downloading orders, saving time and increasing efficiency.

- Email Automation and Multi-Language Support: Set up automated email campaigns with PDF invoices attached; supports multiple languages and currencies for international customers.

- Seamless Integration and 24/7 Support: Integrates smoothly with Shopify, POS, and mobile devices, with constant support available through live chat.

The Fordeer: PDF Invoice Generator app receives outstanding reviews for its user-friendly design, feature-rich platform, and exceptional customer support. Users appreciate its ability to simplify the invoicing process with automation, customization options, and seamless integration with Shopify. The responsive and diligent support team, frequently praised in reviews, enhances user satisfaction, making this app a highly recommended choice for efficient invoice management on Shopify.

Synder is an essential app for Shopify merchants that automates syncing of sales, fees, taxes, and more with popular accounting platforms like Xero, Sage Intacct, and QuickBooks. It offers seamless reconciliation, multi-currency, and inventory syncing, significantly simplifying bookkeeping processes.

- Auto-sync: Automatically synchronizes Shopify sales, fees, inventory, and taxes with QuickBooks, Intacct, or Xero, ensuring accuracy and reducing manual entry.

- Flexible sync modes: Provides options to sync daily summarized entries or each transaction individually, allowing for tailored bookkeeping.

- Historical imports: Facilitates importing years of historical transactions with duplicates protection, ensuring comprehensive financial records.

- Multi-channel support: Automates sales across 25+ platforms, making it a versatile tool for multi-channel sellers.

- Quick setup: Connects all sales channels in under 15 minutes, minimizing onboarding time and maximizing efficiency.

The app's outstanding advantages include excellent customer support and substantial time-savings in bookkeeping, as evidenced by user reviews praising its efficiency and support team's responsiveness.

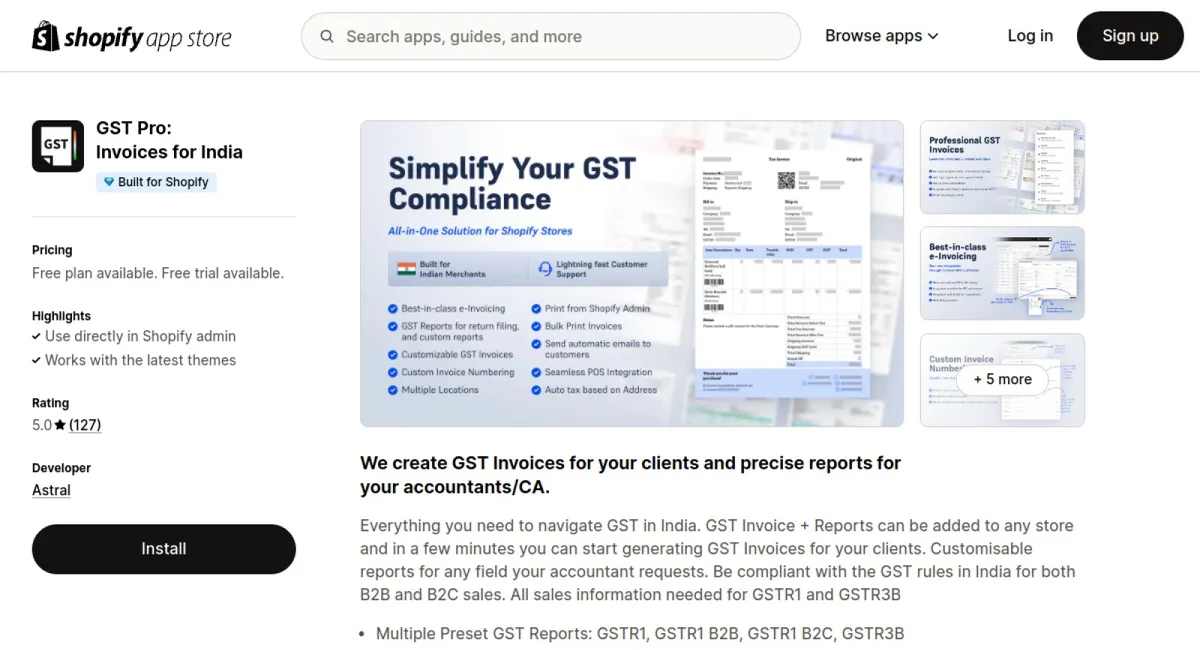

GST Pro ‑ Invoices for India is your comprehensive solution for navigating GST in India. Easily integrate GST Invoices and Reports into any store, enabling quick generation of GST-compliant invoices for clients. The app provides customizable reports and ensures compliance with Indian GST rules for both B2B and B2C sales.

- Multiple Preset GST Reports: Includes GSTR1, GSTR1 B2B, GSTR1 B2C, and GSTR3B reports to streamline your tax process.

- Customizable Reports: Generate personalized reports tailored to the specific needs requested by your accountant.

- Advanced Packing Slips and Refunds: Create detailed packing slips and process refunds with ease.

- Automated Invoice Emails: Seamlessly send GST invoices via email to customers automatically.

- Bulk Report Download: Efficiently download comprehensive reports for your accountants for seamless record management.

In the reviews of GST Pro ‑ Invoices for India, users highlight the app's ease of use, comprehensive features, and excellent customer support as outstanding advantages. The app consistently receives praise for its user-friendly interface, efficient GST management capabilities, and responsive support team, making it a highly recommended tool for Indian startups and existing businesses.

Kintsugi is an AI-powered platform designed for complete sales tax compliance, helping e-commerce businesses handle complex tax requirements like nexus determination, tax calculations, registrations, and filings with ease. Its modern architecture automates sales tax processes, offering high performance, reliability, and flexibility to scale.

- Nexus Determination: Automatically determines where your business has tax responsibilities, simplifying compliance.

- Autopilot Tax Filings: Allows seamless and efficient tax filing, reducing stress and errors in calculations.

- Comprehensive Integration: Works with platforms like Shopify, Etsy, and Amazon, streamlining operations across multiple sales channels.

- Robust Customer Support: Provides 24/7 customer support, ensuring immediate assistance whenever needed.

- Exemption Management: Efficiently handles tax exemptions, reducing complexity and saving time.

Kintsugi is highly acclaimed for its "set it and forget it" approach, praised for transforming tax management from a tedious task into a seamless process. Users particularly appreciate its cost efficiency, automation capabilities, exceptional customer service, and easy integration with popular sales platforms, making it indispensable for efficiently managing taxes across multiple states.

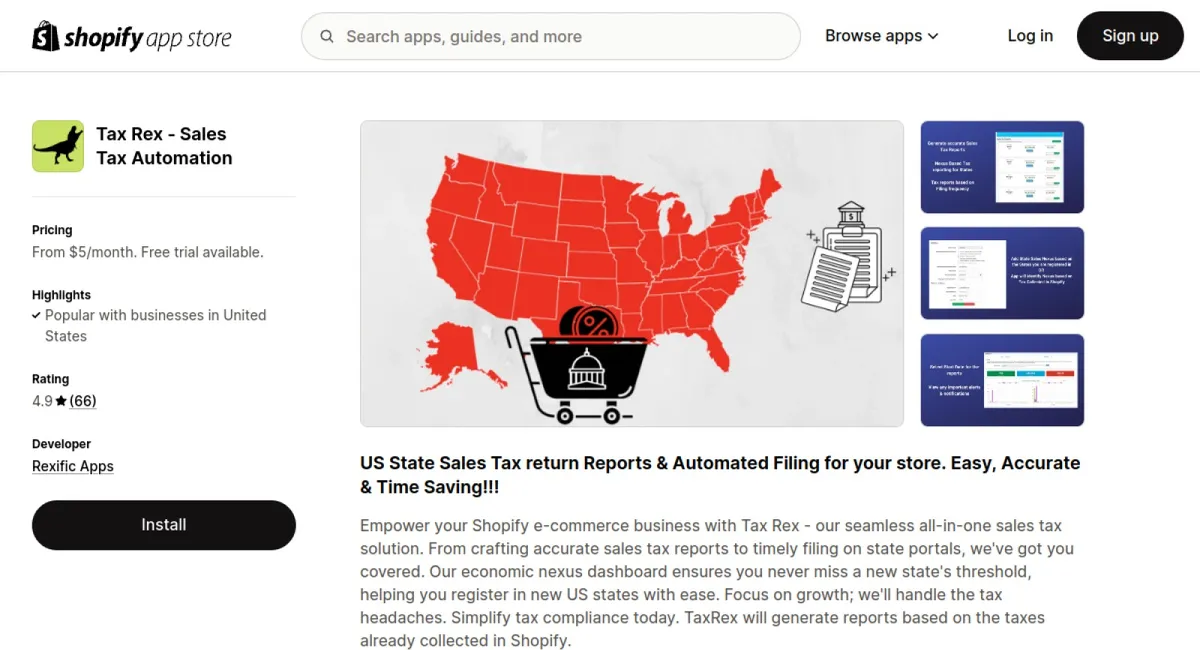

Empower your Shopify e-commerce business with Tax Rex, a seamless all-in-one sales tax solution. From crafting accurate sales tax reports to timely filing on state portals, Tax Rex handles the complexities of tax compliance, allowing you to focus on growth. Its economic nexus dashboard ensures you won’t miss any new state thresholds, making state registration effortless and keeping your business compliant.

- Timely Autofile: Ensure on-time tax return filings while you focus on business priorities.

- Accurate Tax Reports: Provides precise sales tax reports tailored to each state's requirements.

- Economic Nexus Alerts: Stay informed on new state nexus thresholds to prevent compliance issues.

- Effortless State Registration: Simplifies new state registration for seamless compliance.

- Marketplace Integration: Ability to ignore orders imported from marketplaces like Amazon and eBay.

Tax Rex's standout advantage lies in its excellent customer support and adaptability. Users praise the app for its responsive service, seamless filing process, and effective handling of complex tax situations—unlike larger competitors. With Tax Rex, switching from other services is made easy, and its team is lauded for their patience and expertise, gaining strong recommendations from users.

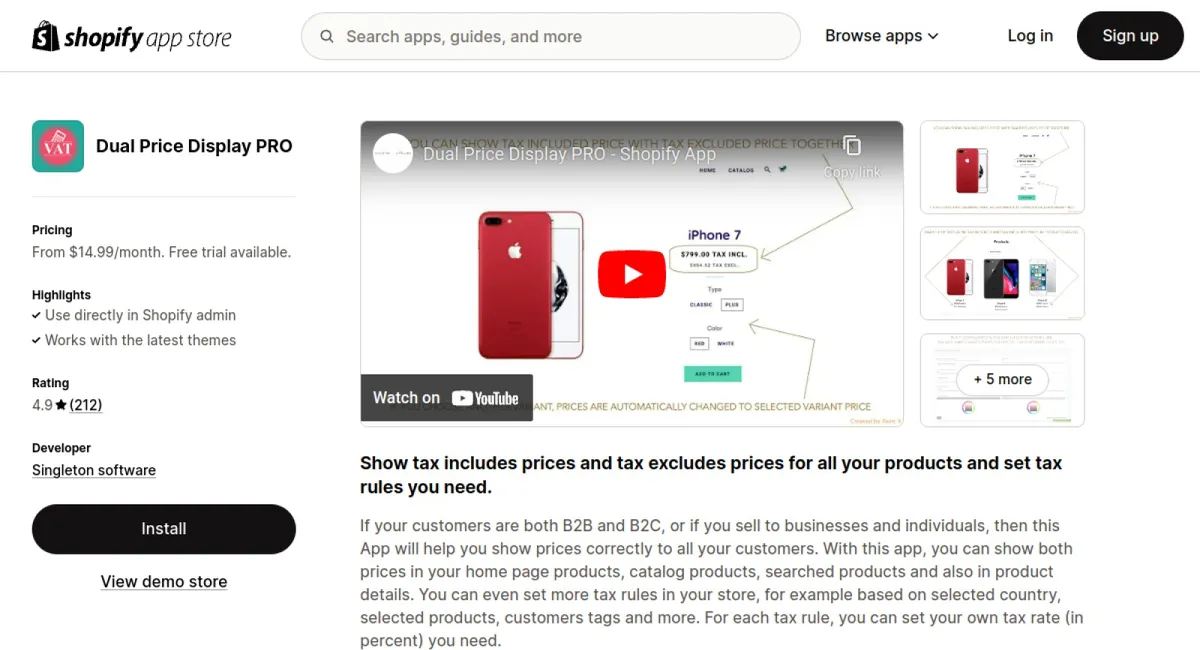

Dual Price Display PRO is designed for businesses serving both B2B and B2C customers, allowing you to accurately display prices with and without tax across your homepage, catalog, searches, and product details. You can customize tax rules based on country, products, customer tags, and more, setting precise tax rates as needed.

- Dual Price Display: Show both tax-inclusive and tax-exclusive prices for all products.

- Custom Tax Rules: Set different tax rates based on country, product type, customer tags, and other criteria.

- Display Options: Choose whether to display both prices, only tax-included, or only tax-excluded prices.

- Customizable Design: Adjust the pricing display to fit seamlessly with the storefront and theme aesthetics.

- Flexible Size Ratio: Set size ratios between both prices to enhance visual presentation (1:1, 1:2, etc.).

This app stands out in reviews for its exceptional customer support, highlighted by users like Adam, who found it incredibly helpful and highly recommend its use, as evident from the perfect 5/5 ratings for reliable performance and assistance.

EAS EU & UK Compliance simplifies the process of handling EU and UK VAT for businesses by automating everything from tax registrations, reporting, and filing to return corrections and currency conversions. It supports a variety of business models, currencies, sales channels, and warehousing needs, ensuring seamless VAT compliance without any adjustments from the user.

- Comprehensive Automation: Automates tax registrations, report generation, filings, and corrections, saving time and effort.

- Multi-Model Support: Adapts to various business models, currencies, channels, and warehouses, offering flexible compliance solutions.

- Quick Onboarding: Users are fully onboarded within hours after registration, ensuring swift VAT compliance setup.

- Seamless Consumer Experience: Provides a hassle-free buying experience for European consumers by eliminating customs fees.

- Shopify Compatibility: Compatible with all Shopify plans, extending its benefits to a broad range of online stores.

The app stands out by offering an effortless setup experience, as highlighted by a user who praised the supportive onboarding process, ensuring that complex setups like IOSS registration are easily managed, making it highly recommended with a perfect rating.

TaxJar Sales Tax Automation is a powerful tool designed to simplify and automate the sales tax management process for businesses. It facilitates seamless sales tax calculations, filing, and reporting, ensuring compliance with various state and local tax regulations.

- Automated Tax Calculations: Automatically calculates accurate sales tax rates for different regions, helping to simplify complex tax compliance requirements.

- Seamless Tax Filing: Provides automated sales tax filing solutions to ensure timely and accurate submission of tax returns across various jurisdictions.

- Comprehensive Reporting: Offers detailed sales tax reports and analytics, providing valuable insights into tax liabilities and compliance status.

- Marketplace Integration: Integrates with popular e-commerce platforms and marketplaces, ensuring smooth tax calculations and reporting for online sales.

- Instant Updates: Keeps track of tax rate changes and ensures all calculations are up-to-date with current laws and regulations.

According to user reviews, TaxJar Sales Tax Automation greatly excels in its user-friendly interface and reliable customer support, helping businesses save significant time by automating and simplifying sales tax processes, ultimately reducing the risk of human error in financial management.

Exemptify is designed to facilitate seamless international transactions for Shopify stores by allowing customers to validate their EU VAT ID for real-time tax exemption. It integrates seamlessly with Shopify Admin and Plus, reflecting accurate pricing according to customer location and new EU distance sales regulations.

- Real-time VAT Validation: Allows customers to instantly validate their EU VAT IDs, ensuring immediate tax exemption.

- Shopify Integration: Easily add VAT IDs to existing customers from Shopify Admin, with direct checkout integration for Shopify Plus stores.

- Location-based Pricing: Automatically displays correct pricing based on the customer's geographical location, enhancing transparency.

- EU Compliance: Fully complies with new EU distance sales regulations, applying the relevant tax rate immediately for accurate invoicing.

- International Sales Facilitation: Boosts international sales by clearly showing what customers will pay at checkout, eliminating confusion over pricing.

Based on user reviews, Exemptify is praised for its user-friendly interface and seamless integration with Shopify, which greatly simplifies the VAT validation process. The app's ability to adjust prices based on customer location is frequently highlighted as a standout feature that enhances customer satisfaction and ensures regulatory compliance, earning high ratings and positive comments for boosting transparency in international transactions.

Staying on top of tax compliance is essential for running a successful Shopify store, especially when selling internationally. With the right tax app, you can simplify calculations, generate accurate reports, and reduce the risk of costly errors.

For expert reviews and trusted recommendations, visit Taranker and discover which tax app is the best fit for your Shopify store in 2025.