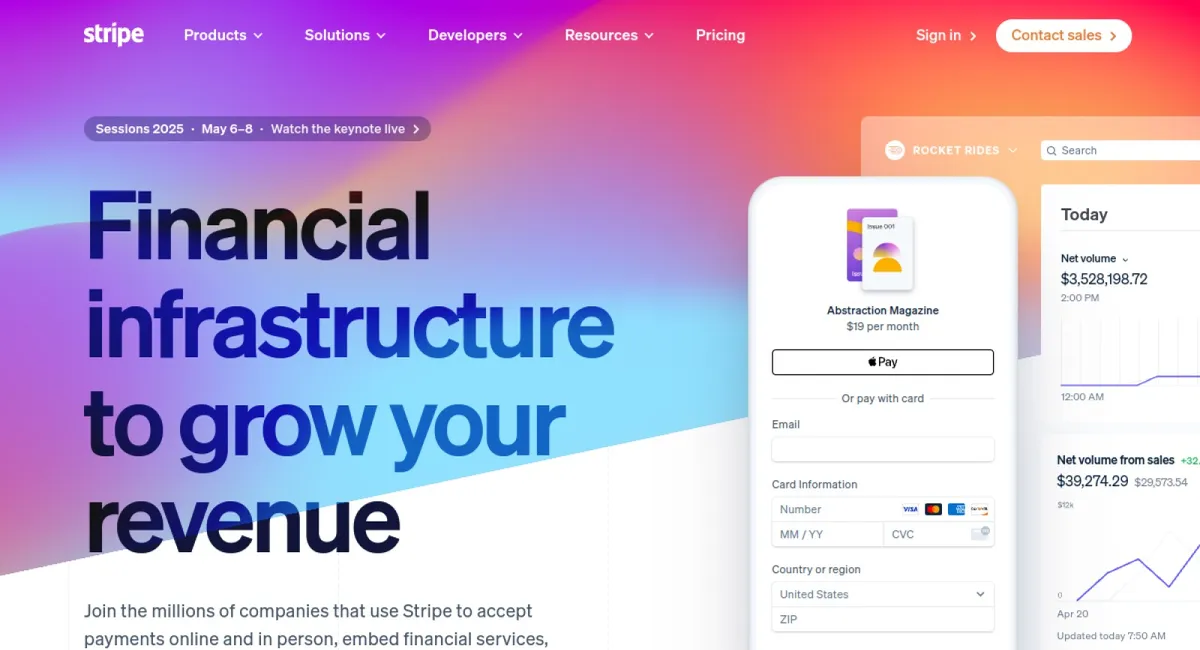

Financial infrastructure platform for businesses to accept payments and manage online revenue

Stripe is a multinational financial services and software company that provides a suite of payment processing and e-commerce solutions. Founded in 2010, it has grown into the largest private fintech company, processing over $1 trillion in payment volume in 2023. Stripe offers tools for online and in-person payments, recurring billing, marketplace payments, and various financial services, catering to businesses of all sizes across nearly 50 countries.

-

Online payment processing

-

Customizable checkout experiences

-

Subscription and recurring billing management

-

Marketplace payment solutions (Stripe Connect)

-

Fraud prevention and security tools

-

Global payment method support

-

Developer-friendly APIs and SDKs

-

Business financial services (banking, lending, card issuing)

-

E-commerce platforms

-

Subscription-based businesses

-

Online marketplaces

-

Software as a Service (SaaS) companies

-

Mobile app payments

-

Platform businesses

-

Global expansion for online businesses